Overview

- By reviewing payment structures and financing terms, buyers can make decisions rooted in clarity rather than marketing appeal.

- This disciplined approach helps avoid surprises and protects long-term capital.

- For buyers seeking transparent, well-structured payment options aligned with premium ownership, Shang Summit offers a model built on financial confidence and foresight.

Condominium payment structures in Quezon City are often packaged to highlight time-bound incentives to shape first impressions. While this promotion is a useful starting point, it rarely shows the full financial picture on its own.

This is why comparing payment options and promotions for QC condominiums requires looking beyond surface-level offers. Requesting detailed quotations from developers and running your own calculations can reveal differences in interest exposure, payment structure, and total cost.

In this article, we walk through how buyers can evaluate payment options with clarity, ensuring decisions are based on complete information.

Steps to Compare Payment Options and Promotions

Comparing payment options and promotions for the QC condominium requires a clear, step-by-step approach to avoid costly mistakes. These steps help buyers assess offers carefully and choose terms that align with their budget and long-term goals.

Calculate Total Cost (TCP)

The Total Contract Price (TCP) is the definitive figure that represents the complete cost of your new residence. It is the all-encompassing price tag agreed upon by the developer and the buyer.

Calculating the total cost of an investment prospect allows you to compare the price per square meter against other options in the market. This ensures you are paying for a fair rate, all while considering value-added factors to the total amount you’ll spend.

Analyze Down Payment Terms

The downpayment structure is often the most flexible part of a condominium deal, especially for pre-selling projects. Investors can look for an ideal rate of equity spread over the remaining construction months, interest-free. In this way, they can guarantee liquidity while the asset appreciates.

Analyze the terms thoroughly so you can decide whether it’s more beneficial to keep your capital liquid for another investment or to lock in a significant upfront discount that reduces your loanable balance.

Compare Financing Options

Choosing between bank and in-house financing can change your monthly obligations by thousands of pesos. Bank financing remains the gold standard for those with good credit.

Meanwhile, while in-house financing is considered more affordable in terms of approval ease, it carries a higher interest rate.

Evaluate “Rent-to-Own” Schemes

Lease-with-Option-to-Purchase plans are popular in RFO units across Quezon City. These are attractive for those who want to move in immediately but aren’t ready for a full payment.

In this setup, a portion of your monthly rent is credited toward the down payment. But before committing, always verify how much of your payment goes to equity versus the rental fee.

Check Hidden Fees

One of the most common pitfalls is focusing solely on the mortgage and ignoring the hidden closing fees. These additional costs can contribute to another 5% to 7% of the total cost.

So, you need to factor in the move-in utilities, association dues, property taxes, and more to establish a clear breakdown of where your finances go.

Key Factors for Comparing Promotions

When comparing payment options and promotions for QC condominiums, it’s important to look beyond surface-level discounts. These key factors help buyers evaluate which offers truly provide flexibility and value.

Pre-selling vs. RFO

The choice between pre-selling vs. RFO is a trade-off between time and cost. Pre-selling units are at the groundbreaking stage. While they offer lower entry price points, buyers usually wait months or even years before finally moving in.

Meanwhile, RFO units are more expensive because their value has already been established, and they offer immediate access. Plan your options depending on your short-term vs long-term financial plans.

Spot Cash vs. Deferred Cash

A spot cash payment, which refers to the agreement to pay the full TCP within a month, is undeniably the one that offers the highest discount from the developer. It eliminates interest fees and other financing fees that inflate over the years.

On the other hand, deferred cash allows you to pay the full price in equal installments over a set period without interest. This is an excellent middle ground for high-income earners who don’t want to part with a large sum all at once.

Furniture and Amenity Inclusions

Fully furnished promos are common incentives used to close a deal in real estate. While getting a professionally interior-designed unit sounds convenient, you must still evaluate the quality and the actual market value of the furniture package.

Aside from value transparency, fully furnished units may also matter for discerning buyers who have specific tastes and want freedom to customize their unit by themselves.

An Overview of Shang Summit’s Payment Terms

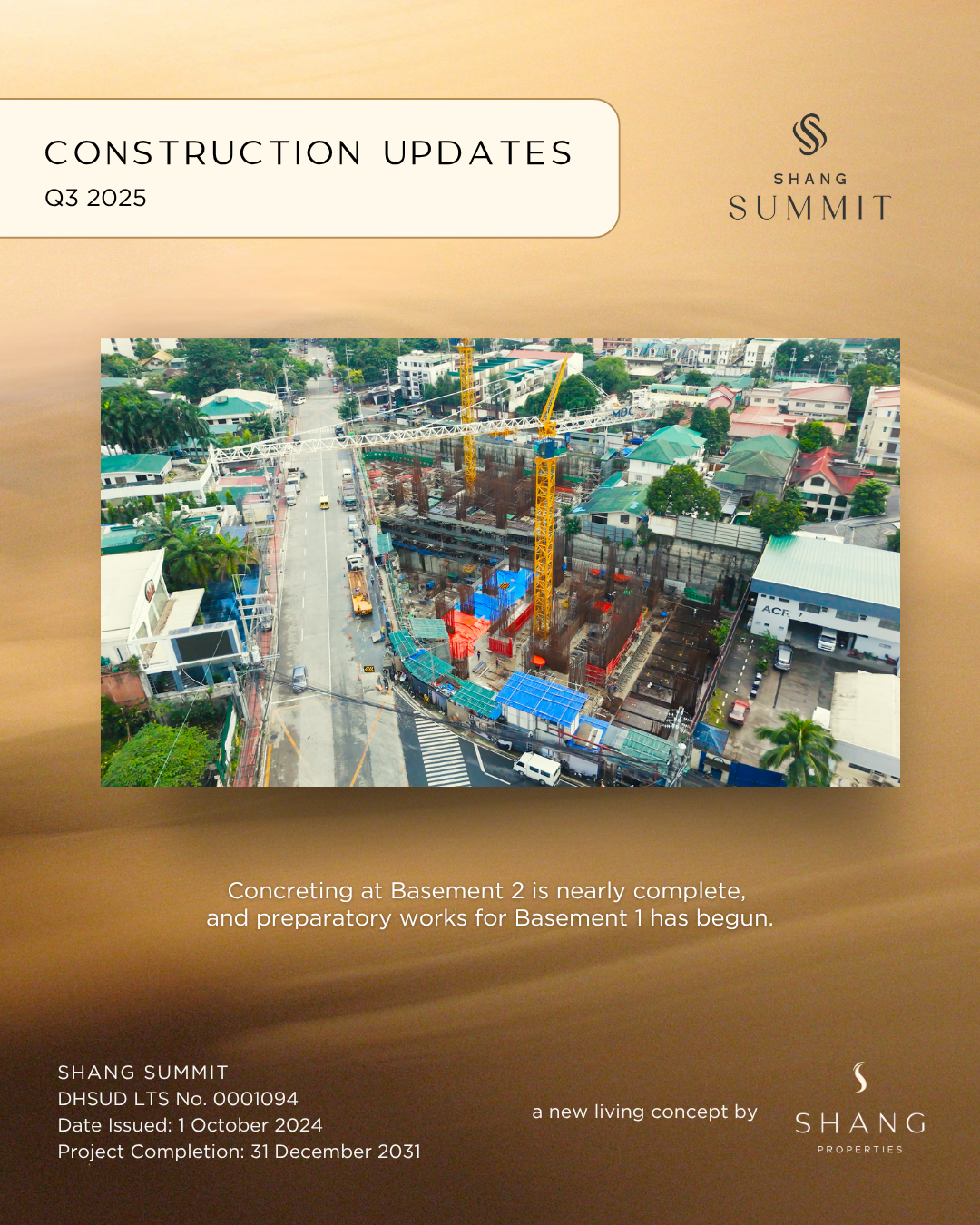

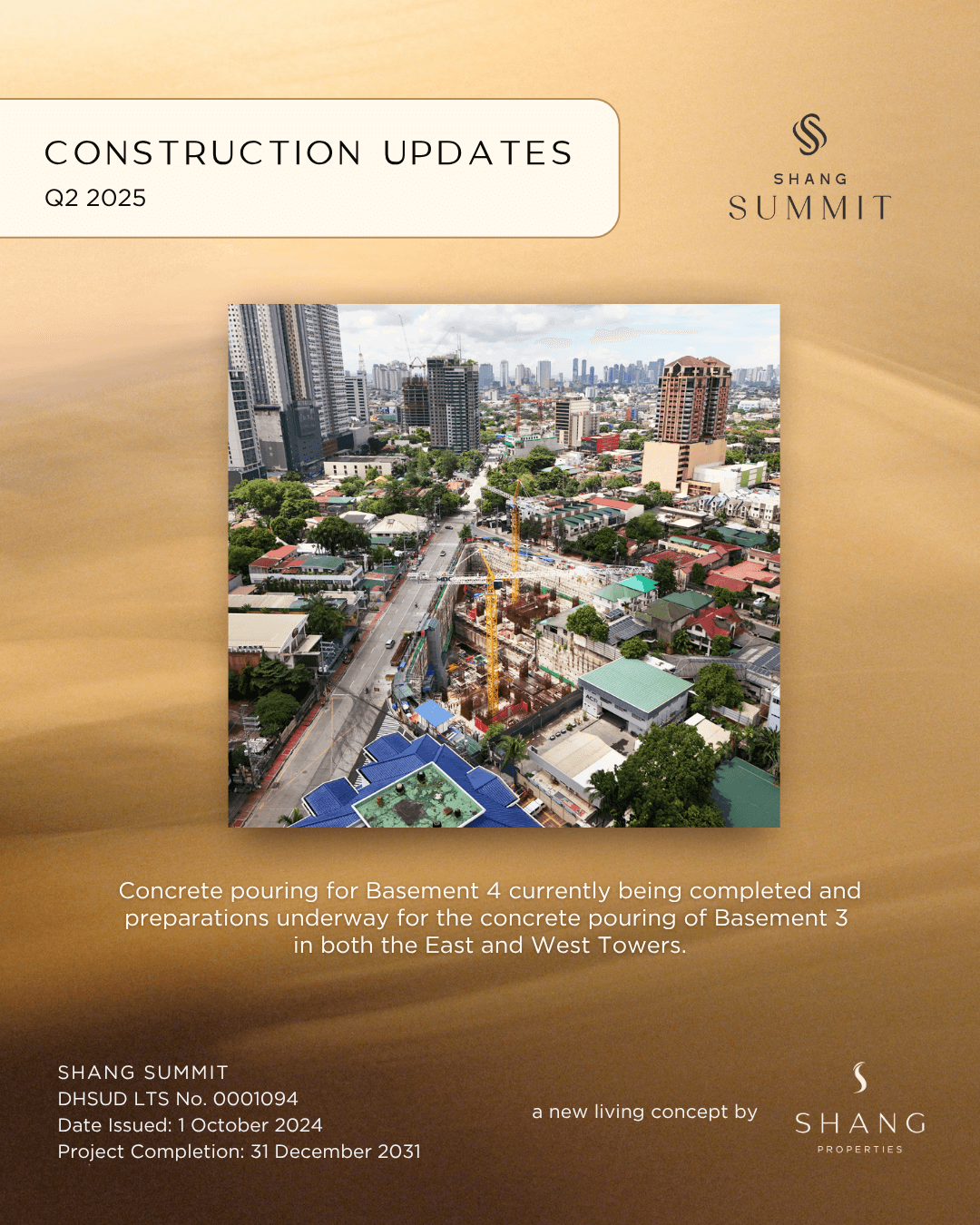

Shang Summit offers a payment structure that reflects its premium status. We provide staggered down payment options that can be spread over the construction period, leading up to its 2030-2031 turnover.

This allows affluent investors to manage their capital more effectively, all while benefiting from early-bird pricing. As part of the Shang Properties’ legacy, our estate also demonstrates all-in pricing for transparency and manageable cash flow.

Key Takeaway

Comparing condominium payment options and promotions in Quezon City is a decision rooted in financial clarity and long-term confidence. Buyers who evaluate full cost impact and payment structure gain stronger control over future commitments.

This level of transparency defines Shang Summit, where payment options are structured to support informed, deliberate ownership. Reach out to us today to review our pre-selling units.